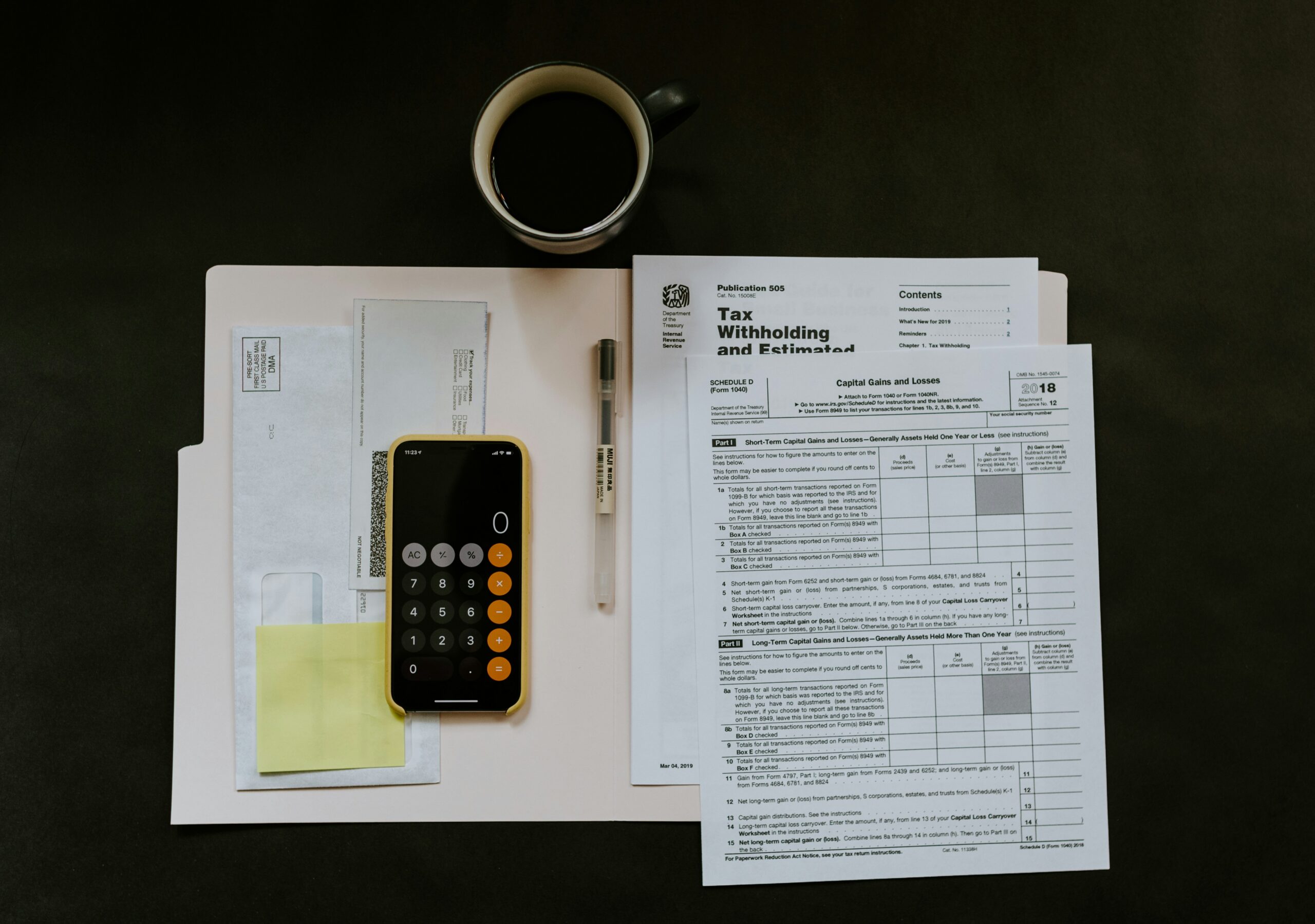

May 29 Handling a Personal Tax Audit: A Guide to Staying Prepared

Facing an IRS audit can be stressful, but staying calm and organized is crucial. Begin by thoroughly examining your tax return, ideally with the help of the preparer or, if you filed independently, a qualified tax professional. The objective is to identify any red flags...