Jun 12 Is Your Financial Info Disaster-Ready?

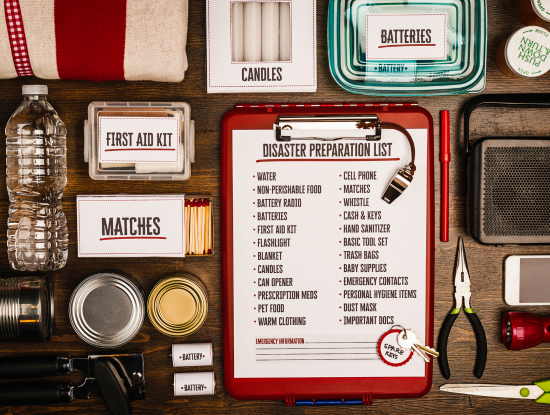

Disaster Prep: IRS Reminds Taxpayers to Safeguard Financial Records The IRS is reminding individuals and businesses that disaster preparation should be part of your annual routine. With tax season behind us and storm season already in motion, June is a smart time to take stock of...