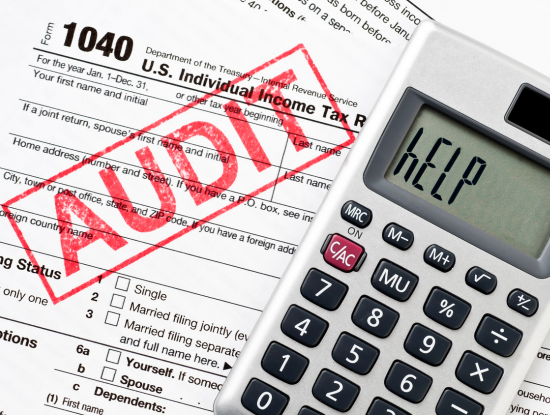

Jun 12 Living or Working Abroad? Your 2024 Federal Tax Return is Due June 16

Who qualifies for the extended deadline? You get this two-month extension (from April 15 to June 16) automatically if either of these apply: You live and work outside the U.S. and Puerto Rico, or You’re serving in the military outside the U.S. and Puerto Rico. To use...