Put Your Children on Your Payroll and Reduce Taxes

One tax reduction strategy that most business owners do not take advantage of is putting their children on payroll.

on payroll.

This can help reduce the overall family tax bill and transfer assets to children without introducing gift tax implications.

As a business owner, you can deduct wages paid to children, while the child can offset those wages with their own standard deduction. In addition to the standard deduction, you could setup pre-tax retirement accounts that would allow taxpayers to deduct more, while the child saves for retirement.

For partnerships and disregarded entities, if your child is under 18, the company does not have to pay employment taxes such as Social Security, Medicare and Workers’ Compensation Insurance. You can also avoid Unemployment taxes until the child turns 21. But for S-Corps and C-Corps, Social Security and Medicare taxes are paid regardless of age. These payroll taxes amount to 15.3% of wages earned, your share and child’s share.

Potential tax savings

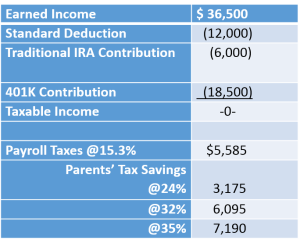

With that in mind, let’s review a sample of potential tax savings. Starting in 2019, the standard deduction is $12,000 for single filers. The maximum contribution to a traditional IRA is $6,000 (if modified adjusted gross income is less than $64,000 for single filers in 2019). Additionally, taxpayers can draft a 401(k) plan that includes no age limitations, which will allow younger children to contribute $19,000 of pre-tax dollars to their 401(k). The example below illustrates the potential tax savings if the taxpayer’s entity is an S-Corporation.

If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential.

If the entity is an LLC instead of an S-Corp, and your child is under 18, add back the payroll taxes of $5,585 to get your tax saving potential.

One other benefit you could produce is a safe harbor 401(k) plan or profit sharing/matching system that could increase your child’s retirement account and provides a deduction for your business. This strategy has plenty of scenarios to take into consideration which provide an opportunity to save even more money in taxes.

There are some rules you need to be aware of when using this strategy:

- Keeping detailed employment records, including timely tracking of weekly hours and wages that correspond to services provided

- Issuing paychecks as you would a normal employee (e.g., bi-weekly)

- Documenting that the services are legitimate and considered ordinary and necessary for the business

- Ensuring the services provided do not include typical household chores

If your child is not treated like any other employee in a similar position, the IRS could potentially deem their wages as not ordinary and necessary, and disallow them as a deductible expense.

We’ve got your back

At KRS, our CPAs can help you strategize setting your children up on payroll to maximize potential tax savings. Give us a call at 201.655.7411 or email me at sfaust@krscpas.com.