Is Your Financial Info Disaster-Ready?

Disaster Prep: IRS Reminds Taxpayers to Safeguard Financial Records

The IRS is reminding individuals and businesses that disaster preparation should be part of your annual routine. With tax season behind us and storm season already in motion, June is a smart time to take stock of your records and make sure you’re ready if the unexpected hits.

The IRS is reminding individuals and businesses that disaster preparation should be part of your annual routine. With tax season behind us and storm season already in motion, June is a smart time to take stock of your records and make sure you’re ready if the unexpected hits.

Earlier this spring, National Wildfire Awareness Month and National Hurricane Preparedness Week (May 4–10) helped raise awareness around readiness. But preparedness shouldn’t stop there.

So far in 2025: FEMA has issued 12 major disaster declarations across nine states due to winter storms, flooding, tornadoes, wildfires, landslides, and mudslides. If it can happen elsewhere, it can happen here too.

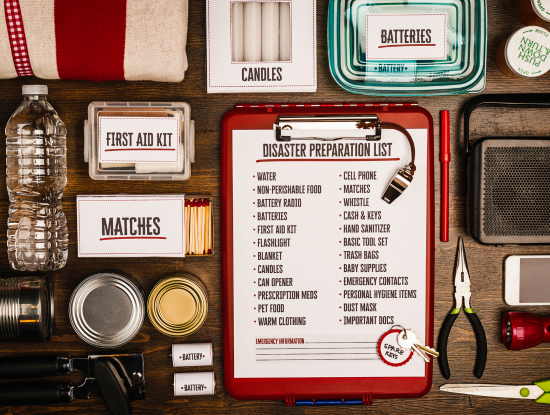

Here are some simple but important steps to consider:

1. Store and Back Up Key Documents

Tax returns, Social Security cards, birth certificates, and property records should be kept in a waterproof container in a secure location. Create copies—physical or digital—and store them off-site or with someone you trust. A flash drive or cloud backup makes portability easy.

2. Create a Visual Inventory

Use your phone to photograph or video high-value items in your home or office. Having a current inventory can help with insurance claims or tax deductions after a loss. IRS Publications 584 (for individuals) and 584-B (for businesses) can help organize your lists.

3. Know How to Rebuild Lost Records

If disaster strikes, reconstructing lost paperwork might be required for tax filings, federal aid, or insurance reimbursements. The more accurate your records, the better your chances of getting the help you need. The IRS Reconstructing Records page is a good first step.

4. Business Owners: Review Payroll Providers

If you use a third-party payroll service, confirm whether they carry a fiduciary bond. This protects your business if that provider can’t make tax deposits due to a disruption.

5. IRS Relief May Be Available

When FEMA declares a major disaster, the IRS often provides automatic extensions for tax filing and payment deadlines in affected areas. If you live or operate in a disaster zone, no action is needed—the IRS will apply relief automatically. Not sure if you qualify? Call the IRS Disaster Hotline at 866-562-5227 to talk with someone trained to help.