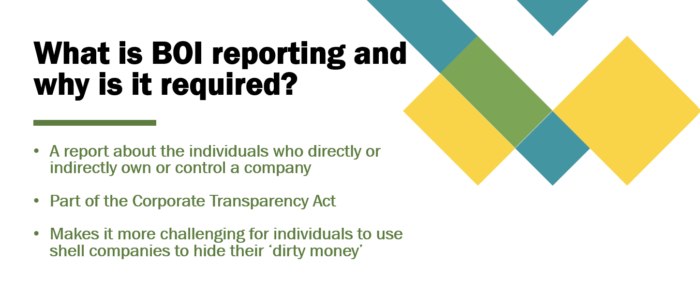

What you need to know about BOI Reporting

The Corporate Transparency Act requires certain types of U.S. and foreign entities to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Beneficial ownership information is information about the entity, its beneficial owners, and in certain cases its company applicants. Beneficial ownership information is reported to FinCEN through Beneficial Ownership Information Reports (BOIRs).

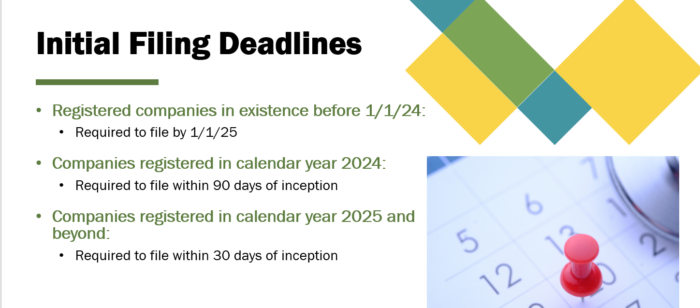

The Who, What, When of BOI Reporting Requirements

Get started here to learn the basics of BOI reporting and BOI information.

Who Is Exempt from BOI Filing?

Currently 23 types of entities are exempt, including Large Operating Companies:

- 20+ full-time employees in the US

- Physical office location in the US

- Filed a federal tax return for previous year with $5M+ in gross sales from US-based sources

BOI FAQs: Beneficial Owner

A quick read answering the questions:

- Who is a beneficial owner of a reporting company?

- What is substantial control?

- Who qualifies for the exemption from the beneficial owner definition?

- Is your accountant or lawyer considered a beneficial owner?

- Who is a company applicant of a reporting company?

Many people involved in the business will be considered beneficial owners. Exceptions:

- Minors

- Employees

- Creditors

BOI E-Filing Portal & Instructions

Quick links to BOI e-filing portal and instruction guide.

Prior Reports

If there is any change to the required information about a reporting company or its beneficial owners in a BOIR that a reporting company filed, the reporting company must file an updated BOIR no later than 30 days after the date on which the change occurred.

Reporting companies must correct inaccurate information in previously filed reports within 30 days of when the reporting company becomes aware or has reason to know of the inaccuracy of information in earlier reports.

What information do you need to provide in the filing?

You’ll need to assemble information on the reporting company, beneficial owners and, in some cases, the company applicant, before starting the filing process.

Penalties for Non-Compliance

Violations include:

- Intentionally failing to file a BOI report

- Intentionally filing a report with false information

- Intentionally failing to correct a BOI report that contains incorrect information

Penalties include

- Fines of $500 per day that the violation continues (civil penalty)

- Up to 2 years imprisonment (criminal penalty)

- Fine up to $10,000 (criminal penalty)

Corporate Transparency Act and BOI Ruled Unconstitutional by Alabama Federal District Court

A federal district court in Alabama has found the Corporate Transparency Act (CTA), which includes the controversial Beneficial Ownership Information (BOI) reporting requirements, to be unconstitutional. The court document includes the statement that the CTA, “exceeds the Constitution’s limits on the executive branch.” The National Small Business Association (NSBA), a trade group, initiated the lawsuit.