What Drives SMBs’ Accounting Software Purchases?

Software Advice™, a trusted resource for software buyers across industries, recently published a trend report on accounting software purchases by small and midsize businesses (SMBs). SMB Accounting Trends Buyer Report – 2016 was based on hundreds of consultations the firm conducted with SMBs over the past year. The report provides excellent insights into what business owners should look for when considering buying an accounting software system to replace outdated software or manual entries (e.g., pen and paper or Excel spreadsheets).

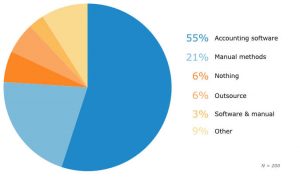

Prospective Buyers Current Accounting Methods

Software Advice analyzed a random sample of consultations and found that nearly 60% of SMBs are looking to replace their existing accounting software with a more advanced system, while roughly 30% are first-time buyers.

35% of buyers seeking upgrades are now using some version of QuickBooks. This comes as no surprise. In my experience working with SMBs, I’ve seen that software packages such as QuickBooks and Sage 50 (formerly Peachtree) are very popular because they are advertised as relatively inexpensive and easy-to-use. Though these solutions provide the basic financial information owners need to prepare their tax returns, they do have limitations on the following:

- The number of user licenses and the ability to set user permissions

- Inventory items and SKUs that can be tracked in the system

- Capabilities for tracking edited/deleted transactions (audit trail)

- Integration with operational, industry-specific software

SMBs Requirements for Advanced Functionality

According to the trend report, the majority of buyers desire greater system capabilities. Buyers want the new software solution to be able to:

- Handle multiple entities

- Consolidate data and accounts

- Run payroll in-house

At KRS CPAs, we’ve noted that handling multiple entities is often a tipping point for businesses progressing from basis to advanced accounting solutions. When businesses try to perform the function with a solution that isn’t designed to support multiple entities, the process is time consuming and error-prone.

For example, inter-company transactions processed by larger software applications are handled in one entry. If the application doesn’t offer multi-entity access, then the entry must be recorded in each entity separately, which is time consuming and can result in mistakes.

Software Advice also reported that the 21% of buyers wanting to automate processes correlates with the same percentage currently managing their accounting with manual methods, such as Excel spreadsheets. These buyers are looking to improve efficiency by reducing time spent on manual data entry.

Financial Reporting Capabilities Are Crucial for SMBs

82% of buyers wanted financial reporting in their new software solution in order to measure key financial and performance metrics. I typically advise clients to ensure their new system has basic reports, including the balance sheet, profit and loss statement (P&L), and cash flow report. The P&L acts as the starting point for tax planning, while the balance sheet reports cash levels, debt and retained capital in addition to assets and liabilities.

Accurately tracking and reviewing this financial data on a regular basis gives business owners insight into financial history, department efficiency and the profitability of different ventures. This allows them to make more informed decisions regarding cash flows, budgets and projections.

Cloud Solutions Grow in Popularity

Another accounting trend SMBs should be aware of is the growing popularity of cloud-based solutions. Software Advice identified these benefits of moving accounting to the cloud:

- Greater ease of access

- Better security

- Improved ease of use

I’ve also seen that cloud-based systems provide more integration and add-on options, which allows users to extend the reach of their existing systems to serve many industry-specific needs.

Ready to Get New Accounting Software?

If you’re ready to start evaluating accounting software, Software Advice offers an online accounting software questionnaire that can help you match your business needs with several products for you to assess.